Why News Trading Fails

Global political tensions are on the rise in the Middle East. Many investors are tempted to quickly sell their portfolios in response to recent news, and while this reaction seems reasonable, it likely won't be profitable. Let's look at a local example to understand why you should be wary of trading based on news.

From 2020 to 2024, ABS-CBN reported losses exceeding ₱30 billion.

In May 2020, the company lost its broadcasting rights, which was the core of its business. To stay afloat, ABS-CBN had to sell properties to cover debts and renegotiate loans with banks. It was an awful time for the company.

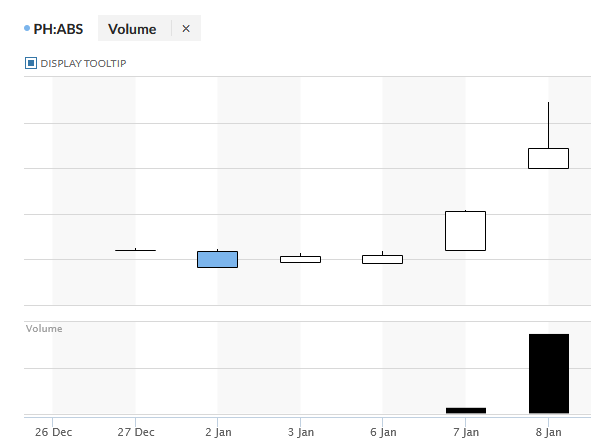

Then, after four years of substantial losses, on Jan. 7, 2025, after markets closed, great news arrived. The Philippine News Agency published an article titled: “Bill granting ABS-CBN new franchise filed in House.” This was the best news the markets had seen for ABS-CBN in recent memory, and everyone was ready to pounce the next day as soon as markets opened.

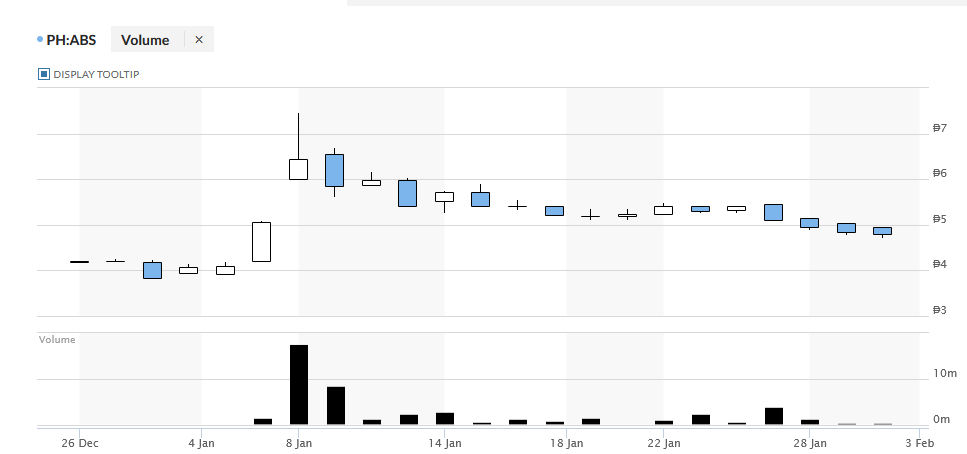

The stock was at ₱5.06 per share. The next day, after the news broke, the stock instantly opened at ₱6, bypassing any intermediate prices. Within the first 20 minutes of trading, it rose to around ₱7.

However, after briefly peaking around ₱7, the stock began a continuous decline over the next few days. A significant spike in volume occurred about two days later, after its price had returned to the ₱6 mark. The vast majority of short-term traders who tried to profit from the ABS-CBN news ended up losing money.

It’s nearly impossible to make outsized profits from news.

Why? Because news is publicly available information. Everyone can act on it. That’s why the stock opened with an instantaneous leap: everyone already knew about the franchise renewal, so they immediately started demanding ₱6 per share instead of the previous ₱5, with no room to buy at any price in between.

Prices change in response to expectations, and once prices align with these expectations, they tend to stabilize rather than continue rising. This ability of markets to incorporate all known information into prices, ensuring that you won't have uniquely profitable investment insights, is called “Market Efficiency.”

The ABS-CBN example is a relatively minor illustration of market efficiency.

In many instances, prices can move even before the news is published. This happens because knowledgeable and skilled institutional market participants—like funds, banks, and insurance companies—have the resources to obtain important information first.

That’s why if you look at the price of gold this past June, you’ll notice it started rising from $3,320 per ounce on June 11 to around $3,430 per ounce on June 13. When did Israel strike Iran? On June 13, after the price of gold had already risen. For the rest of June, gold prices have been on a downtrend. If you bought gold after the missile strikes, your portfolio would be down right now.

By the time you heard about the missile strikes and felt enough fear to buy gold, gold had already finished its uptick.

Faster, more skilled, and better-armed institutional investors had already used every tool in their multi-million-dollar arsenal to acquire those insights first. They had already been buying for days. You just arrived at the party, and they've already taken all of your upside.

Efficient markets mean that the early bird with a world-class research team gets the worm. The late bird gets nothing.

So what are we to do in the face of such fast competition?

If well-armed investors will always beat us to the news, the only profitable thing we can do is to invest in a way that doesn't require early information.

You could invest in a diversified index fund and let time do its thing. You could also take advantage of unique insights in specific industries where you're sure you have an information advantage.

But no matter which strategy you choose, you must make your decision knowing that markets are a multi-player arena where you compete against the fastest, brightest, and most well-funded investors in the world.

While you might be tempted to invest based on the news, always remember that you must get it earlier than everyone else for it to be profitable. So, the next time you're tempted to trade based on news, remind yourself: Only the early bird gets the worm. The late bird gets nothing.

First published in the Manila Bulletin.