When stop-losses don't stop losses

On Oct. 10, 2025, global markets plunged after United States (US) President Donald Trump announced he would impose an additional 100-percent tariff on goods from China. The reaction was immediate and violent, particularly in the cryptocurrency market, which suffered its largest liquidation event ever. Around $19 billion in positions were wiped out within hours. Prices rebounded just as quickly, but for many traders, the damage was done. A friend of mine who trades these markets said that people in his trading group lost vast sums of money during the fiasco, particularly because of a combination of leverage and stop-losses.

According to Investopedia, a stop-loss is an order that tells your broker to automatically sell a security once it hits a certain price. For example, let’s say you buy a cryptocurrency at $20 and set a stop-loss at $15. When the price drops to $15, your position will automatically be sold at the prevailing market price. In theory, this limits your downside to $5 per unit.

However, when prices collapse too fast, stop-losses can execute at prices far below your intended threshold. This is what happened on Oct. 10. The market didn’t gradually slide from $20 to $19 to $18; it fell straight through, with only a few traders able to activate their stop-losses at higher prices due to the lack of buyers in the market. Someone who placed a stop-loss at $15 could have found their position sold at $5 because prices immediately crashed to $5 before their stop-loss could be filled. And, to add salt to the wound, after being completely sold out at the bottom, that same person might have watched the market recover to $12.

For those trading with leverage, the damage was even worse. Many people borrowed funds to amplify their bets, believing their stop-losses would protect them. When prices crashed, these positions were automatically liquidated at extreme lows, wiping out entire portfolios in seconds.I often hear people confidently say that stop-losses are a guaranteed form of risk management. “If I buy at $20 and set my stop-loss at $18, then the most I can lose is $2!” they would say. But stop-losses don’t always stop losses. There’s always the possibility, no matter how small, that you will end up being forced to sell at prices lower than where you set your stop-loss.

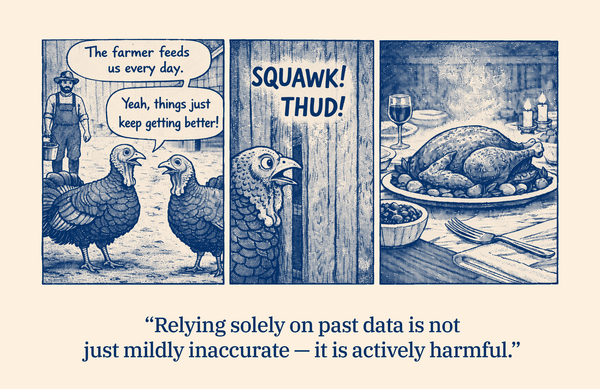

Stop-losses assume that the market moves gradually. You imagine a line that moves up and down in small steps, letting your order trigger neatly at your chosen level. But prices don’t always move in steps. They sometimes jump. When liquidity is low or when shocking news hits, prices can quickly break through or even skip over entire ranges, jumping from one level to another with few or no trades in between.

These leaps are not confined to cryptocurrency markets and can appear even on our local stock exchange. On Jan. 7, 2025, ABS-CBN’s share price closed at ₱5.06. That night, Philippine News Agency (PNA) reported that the company had been granted a new franchise. This was excellent news that deserved a higher stock price. When the market opened the next morning, the stock didn’t climb gradually to ₱6—it opened there instantly. No trades occurred between ₱5.06 and ₱6. Why? Because overnight, investors collectively agreed that the new information increased the company’s worth, so they refused to sell below ₱6.

Returning to the cryptocurrency fiasco: When Trump’s tariff announcement hit, traders instantly decided that their cryptocurrencies were worth less than current prices, not by small increments but by entire leaps. Few wanted to buy at the old prices. A massive number of stop-losses triggered at the same time, but only few buyers were left to support higher prices, so prices broke downwards. This resulted in traders experiencing much larger losses than their originally planned stop-losses.

This isn’t to say stop-losses are useless. In calm markets, they can help prevent large losses from slowly accumulating. They work well in liquid securities with steady price movements and deep order books. But once in a while, when huge, market-changing news catches traders by surprise, they can fail in spectacular ways.

When it comes to risk management, it’s essential to understand how your tools will behave under pressure. Stop-losses protect you when markets are orderly, but they can break when markets crash. Even if stop-losses are a convenience that works most of the time, they are not a 100-percent guarantee. Sometimes, not even stop-losses can stop losses!

First published on the Manila Bulletin.