"Should I Buy The Dip Or Stay In Cash?" How to Invest During Chaos

It’s April 2025 as I write this, and the world is once again on edge.

Earlier this month, former President Trump announced sweeping new tariffs, bringing the average U.S. tariff rate to 22%—the highest level since 1910 [1]. Markets responded swiftly. The S&P 500 dropped between 5% and 6% over two days [2], wiping out more than $5 trillion in market value. For context, that’s a deeper loss than the initial shock of the 2020 pandemic. [3]

Trump has since added a 90-day grace period before most of the tariffs take effect [4]. But the damage, at least psychologically, has already been done. Markets are volatile, and headlines are noisy with panic.

Because of this chaos, many people contacted me this past week, asking, “Should I buy the dip? Or should I stay in cash and wait for things to get worse?” So to answer this frequently asked question, I’m writing this piece for friends, family, and anyone else who needs a clear investing plan—something you can stick to even when uncertainty is front-page news.

As always, a quick disclaimer.

This article is for educational purposes only. Markets are complex, and only you can know what’s appropriate for your situation. Please invest responsibly.

DON’T PANIC

In the classic sci-fi novel The Hitchhiker’s Guide to the Galaxy, there exists The Hitchhiker's Guide – an all-knowing compendium of facts, trivia, and survival advice for intergalactic travelers.

It explains how to survive being thrown out of an airlock, what to expect from alien bureaucracy, and even how to mix various cocktails. But despite its encyclopedic knowledge, its most important advice is written on its cover, printed in bold letters: “DON'T PANIC".

This advice doesn’t just apply to intergalactic travel - it’s a surprisingly useful principle for investing, too.

Panic is one of the costliest investor behaviors.

A study by Fidelity showed that from 1980 to 2022, if you had missed just the 10 best-performing days in the U.S. stock market, your ending balance would have been cut by nearly 60% [5].

And those “best days” tend to arrive shortly after the worst events [6]:

- Just 3 months after the Cuban Missile Crisis, US stocks rose by 13% [7].

- After 9/11, by the end of 2001, stock prices had risen by 4.05% [8].

- In 2004, Spain’s IBEX 35 fell 6.7% in three days after the Madrid train bombing—then went beyond fully recovered within a month, increasing by 8.43% a year later [9].

- In 2005, London’s FTSE 100 dropped nearly 4% following the transport attacks, but it was back to pre-crisis levels the next day and went up an additional 2.39% in just a month [9].

If bad headlines spook you into selling, you might miss out on the largest market upswings.

And yet, we all know how people panic once volatility starts to kick in.

Everyone has that one uncle, aunt, parent, or friend who, as soon as the markets begin to tumble, yells out, “Things are looking bad! We should get out of the market and wait until things look good again!” Sadly, that mindset often leads to buying when prices are high and selling when they’re low.

Morningstar conducted an interesting study. They found that, during the study period, various funds they studied were making 7.7% per annum. And yet, the investors of those exact same funds were only making 6% per annum! [10]

How was that possible? Why were the investors making less than the funds they were investing in?

The answer: these investors exited during downturns (Imagine your hypothetical uncle screaming: “Sell everything! The market looks bad!”) and only came back after the recovery was in full swing, missing the initial, strong bounce back from the bottom (“Things are trending up now! Time to get back in the market!”).

So, DON’T PANIC.

Keen observers will notice that our hypothetical uncle in this scenario is executing a common strategy called “Sell Low, Buy High”: They exit the markets during the bottom at maximum fear and buy back during peak euphoria. This is the complete opposite of a sound investing strategy, which aims to buy low and sell high.

As you can see, letting panic and emotion guide your decisions can destroy your portfolio. So, to have a good investment plan, you must reduce and, if possible, eliminate emotional decision-making.

How do we do this? The first step isn’t a better stock pick or timing model. It’s building your emergency fund.

Get an Emergency Fund

Nothing is more effective for staying calm during a downturn than having an emergency fund.

An emergency fund is a pool of cash separate from your investments. It’s there for unplanned expenses—medical bills, job loss, car repairs—so you’re never forced to sell assets when markets are down.

More than anything, your emergency fund will keep you from panic-selling. Even the best investment strategy is worthless if you’re forced to sell because you don’t have enough cash to pay your bills.

How big should your emergency fund be?

Most recommendations suggest keeping 3 to 6 months’ expenses in cash or cash equivalents [11]. If your income is stable, you might be fine with less. If you work freelance or have variable income, consider holding more.

The longer you expect to ride out volatility, the larger you'll want your emergency fund to be. Some people even keep 12-month emergency funds! And while that might seem like a lot of opportunity cost in unproductive cash, anyone who has lived through a cash crunch will tell you it’s worth it for your peace of mind.

To help plan your emergency fund, here’s some relevant data:

- Over the past 40 years, U.S. recessions have lasted around 10 months on average [12].

- The most prolonged recession in history—the Great Depression—stretched nearly a decade [13].

- More recently, the Great Recession lasted about 18 months [14].

As a rule of thumb, make it large enough so you’ll never have any regrets. When (not if!) markets crash, your emergency fund should be large enough that you won’t say “I regret not putting more.” [15]

Do not skip this step. Many financial horror stories begin with someone going all in on investments, only to be forced to sell at a loss because of a family emergency, natural disaster, or even a car breakdown.

Once you have an emergency fund, you’re ready to think about investing. Many people have a misconception that this means trying to find the bottom of the market so they can buy when things are at their cheapest. But sadly, there is no evidence that market timing is a sustainable strategy [16][17][18][19][20][21]

Avoid Market Timing

As the many studies and articles I cited in the previous paragraph show, market prices are unpredictable. In most cases, no one knows when the bottom is in—not even pros. And for that rare time when somebody makes a correct market call, it’s probably a one-time shot of luck, rather than a sustainable, repeatable investment strategy.

Still skeptical? A simple thought experiment.

Even if you ignore the studies cited above, consider this logic.

If there existed even a single person who could consistently time the market, they would be the richest person alive. They would compound wealth faster than anyone else, and their every trade would be immensely profitable. We wouldn’t be talking about Bill Gates and Elon Musk - we would be talking about this mythical market timer instead.

So, where is this market-timing Midas of ours? In our dreams. This person does not exist. Among the list of the richest people in the world, I see no market timers:

The fact that such a person doesn't exist should make it evident to anyone that reliable, accurate market timing is a pipe dream. If you can’t find reliable market timers in the upper echelons of the investment profession, it’s obvious that you won’t find them among regular retail investors like you and me.

Hopefully, this little thought experiment and the massive number of academic, peer-reviewed studies you can google about how market timing doesn’t work will convince you not to try it.

I highlight this point because attempting to market time can do immense, irreversible damage to your portfolio.

As mentioned earlier, missing just the 10 best days in the market for your portfolio can reduce your lifetime earnings by almost 60% [5]. So if one of those best days just happens to come while you're trying to market-time the bottom, you can say goodbye to a massive chunk of your retirement.

The risk of missing out on such huge gains shows that market timing is incredibly dangerous and should not be attempted by most people.

So what should you do instead?

Make an Asset Allocation Plan—and Stick With It [22][23][24]

An asset allocation plan dictates what assets you’ll hold in your portfolio and how much of each asset you’ll hold. That means deciding:

- What kinds of assets (stocks, bonds, cash, etc.) you’ll hold

- What percentage of your portfolio goes to each of these assets

- When—and how—you’ll rebalance to maintain that mix

Why does having an asset allocation plan matter?

- Risk Management: Asset allocation helps spread risk across different asset classes (e.g., stocks, bonds, cash), reducing the impact of any single investment on your overall portfolio

- Aligns with Financial Goals: You can tailor your investment mix with your time horizon, risk tolerance, and income needs, aligning your portfolio with your financial objectives.

- Rule-Based Decision-Making: If you have an asset allocation plan, you don’t need to worry about when to buy and sell. Your asset allocation plan will instead tell you what to do, reducing the risk that you’ll make bad, emotionally-driven decisions.

How should you go about making your asset allocation plan? While there are infinite ways to organize your plan, I prefer to keep things simple with a method called “constant-weight asset allocation.”

Constant-weight asset allocation

For most people, the easiest asset allocation plan is to have a constant-weighted target asset allocation where you try to maintain target percentages per asset by rebalancing over time.

While this sounds complicated, it’s quite simple once you try it. You’ll only need to answer two questions:

- What assets will you hold in what percentage allocations?

- When will you rebalance your portfolio?

Let’s tackle them one at a time.

Question 1: What assets will you hold in what percentage allocations?

The first decision is how much of each asset class you want to hold. To keep things simple, we’ll only talk about stocks, bonds, and cash here, but you can always add other assets like real estate, gold, and private equity to your portfolio. Each asset class has its tradeoffs for risk, gains, liquidity, cash flow, and other characteristics, so do your research to find the mix that’s right for you.

Here’s an example asset allocation plan:

- 60% stock

- 30% bonds

- 10% cash

Note that this asset allocation is for your active portfolio only. Your emergency fund should be in a separate bucket.

How should I mix my assets?

The mix you choose depends on your risk tolerance and your investment horizon.

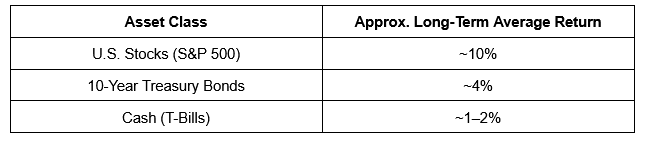

As a rule of thumb, assets with higher volatility, like stocks, also have higher long-term returns, while assets with lower volatility, like bonds, have lower historical long-term returns.

The standard textbook approach is to adjust the mix based on your age: younger investors can afford to take more risk and hold more stocks, while older investors may want to reduce volatility by holding more bonds and cash.

Some investors, especially those with a long runway and a strong stomach for drawdowns, opt for a 100% stock allocation. Historical data supports this as a viable option over multi-decade horizons—if you can stay the course [25][26].

The only allocation I caution you against is any allocation with no growth assets like stocks.

Stable assets have their risks!

There’s a common misconception that stable assets like bonds and cash are safer than volatile assets like stocks.

I urge anyone considering a 100% bond or cash portfolio to try adding stocks or other growth assets. Remember that the goal of personal finance is more than just stability - it’s to achieve your personal financial goals. And if you have enough cash flow from other sources (like a stable job or business) to pay for your day-to-day expenses, overweighing your portfolio with stable assets unnecessarily slows down your ability to grow your wealth.

Consider that over the past 95 years of US market history, $100 invested in stocks would have turned into more than $787 thousand, while bonds would’ve just turned into $7 thousand—an over 100x difference over the past century [28].

In my opinion, nothing is more financially unsafe than allocating all of your portfolio to stagnant, stable assets. Having insufficient growth assets in your portfolio massively increases the probability that you won’t meet your financial goals.

In my eyes, a stable portfolio that remains too small to meet your future expenses is even more worthless than a highly volatile portfolio with a chance to implode. Why? Because the volatile portfolio at least has a chance at making a moonshot-level return. With the stable portfolio, you guarantee failure: the assurance that your portfolio will not go down is also the assurance that your portfolio will not go up.

Again, this is not financial advice. Consider your situation, because returns from volatile assets only become apparent over decades. But do consider these assets. The most common mistake I see people make around me is allocating way too much of their portfolio to stagnant, stable assets, guaranteeing zero growth and losses to inflation.

Now that you’ve decided on your asset mix, you’ll want to think through your rebalancing period.

Question 2: When will you rebalance your portfolio?

Once you’ve set your target percentages, the next step is to decide when and how to rebalance your portfolio so that it continues to approximate your target asset allocation.

Over time, asset prices move, and your portfolio drifts from its original allocation. Rebalancing means adjusting your holdings so they return to your target allocation: buying more of what’s lacking and selling what’s overweight.

There are a few ways to handle rebalancing:

- Time-based rebalancing: Rebalance on a regular schedule—monthly, quarterly, or annually. For example, if you invest your monthly salary, you can use that opportunity to top up whichever asset class is below target.

- Threshold-based rebalancing: Rebalance whenever your allocation drifts by a certain percentage. For example, if you’re targeting 50% stocks and 50% bonds, and the mix shifts to 45/55 or 55/45, that could trigger a rebalance to return your portfolio to the target 50/50 allocation.

You don’t have to follow these rules. You can be creative with your rebalancing.

The method doesn’t need to be perfect. What matters is that you follow a process consistently. Rebalancing on a schedule or threshold gives you a mechanical way to manage risk without relying on emotional decision-making.

Here’s a quick example of what rebalancing looks like.

- Let’s say you have an 80/20 portfolio: 80% in stocks, 20% in bonds.

- Then stocks fall sharply, changing your portfolio balance to 60% stocks and 40% bonds.

- In your next rebalance, you can sell some bonds and buy more stocks, restoring your portfolio to your target 80/20 allocation.

Rebalancing makes you buy low and sell high.

The more stocks drop, the more you buy during rebalancing periods. The more they rise, the more you trim. You don’t need to predict market moves. Your portfolio responds to them by design.

This doesn’t eliminate risk (eliminating risk while expecting decent returns is impossible). But it does provide a disciplined framework. Instead of making decisions emotionally, having an asset allocation plan gives you a set of logical rules to follow so that you end up buying more as an asset drops (buying low) and selling as an asset rises (selling high) – all without having to guess when the market will bottom.

Conclusion: When in Doubt, Don’t Panic

When markets start falling, it’s tempting to react—to sell everything, change strategies, or retreat into cash. However, reacting emotionally often turns temporary losses into permanent ones.

If the question is "How should I invest during periods of chaos?", ultimately, the answer is this: If you have a good plan, just keep following it – don't dump your plans just because of a temporary market downturn. If you don't have a plan, make one and follow it.

Start by making sure you have an emergency fund. It acts as a buffer between you and the market, shielding you from being forced to liquidate your assets at the bottom of a downturn.

Next, define your investment strategy. Personally, I’d avoid market timing. It does not have a history of working well [16][17][18][19][20][21], and the potential downside of being wrong and out of the market during an uptick is huge. Remember: missing just the best 10 days in the market between 1980 and 2022 would have reduced your ending portfolio by nearly 60% [5]. And those “best days” usually appear right after the worst days [6].

Instead of trying to time the market, a more reliable strategy is to follow a constant asset allocation plan:

- Decide on your asset mix based on your risk tolerance—how much of your portfolio should be made up of stocks, bonds, cash, or other assets?

- Choose your rebalancing rules. Will you rebalance on a schedule, every payday, or only when your portfolio drifts from your targets?

Once that structure is in place, follow it. Let the rules guide you. By acting systematically, you remove emotion from your decision-making and act in a logical, cool-headed manner even when the markets are in chaos.

And of course, always remember the most important rule: DON’T PANIC. Stick to your plan, and let discipline do the heavy lifting. When the chaos is over and the dust settles, your future self will thank you.

References

[1] Burns, D. (2025, April 3). US tariff rate rockets to 22%, highest since 1910, Fitch Economist says | Reuters. Reuters. https://www.reuters.com/markets/us/us-tariff-rate-rockets-22-highest-since-1910-fitch-economist-says-2025-04-02/

[2] Goldman, D., & Towfighi, J. (2025, April 4). Dow plunges 2,200 points as tariff tumult rocks markets | CNN Business. https://edition.cnn.com/2025/04/04/investing/stock-market-dow-tariffs/index.html ‘

[3] Valetkevitch, y C. (2025, April 5). S&P 500 loses $5 trillion in two days in trump tariff selloff | Reuters. Reuters. https://www.reuters.com/markets/global-markets-wrapup-1-2025-04-04/

[4] Wile, R., Long, C., & Pettypiece, S. (2025, April 9). Trump suddenly backs off global tariff plan after days of economic and market turmoil. NBCNews.com. https://www.nbcnews.com/business/economy/trump-tariffs-president-announces-90-day-pause-what-to-know-rcna200463 [5]Stay invested: Don’t risk missing the market’s best days. Fidelity Investments. (2022, Winter 31). https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/dont-miss-best-days.pdf

[6] Papic, M. (2021). Geopolitical alpha: An investment framework for predicting the future. John Wiley & Sons, Inc.

[7] Ma, J. (2025, March 23). The Cuban Missile Crisis has a lesson for today’s stock market as the next trump tariffs could fuel a considerable rebound, top wall street forecaster says. Fortune. https://fortune.com/2025/03/23/stock-market-outlook-trump-reciprocal-tariffs-rally-bottom-recession

[8] Davis, M. (2023, September 11). The impact of 9/11 on business. Investopedia. https://www.investopedia.com/financial-edge/0911/the-impact-of-september-11-on-business.aspx

[9] Ramnarayan, A., & Pal, A. (2025, March 24). Markets typically unfazed by terror attacks as economies soldier on. Reuters. https://www.reuters.com/article/britain-security-markets-idUSL5N1H0379/

[10] Ptak, J. (2023, August 2). Bad timing cost investors one fifth of their funds’ returns | morningstar. Morningstar. https://www.morningstar.com/funds/bad-timing-cost-investors-one-fifth-their-funds-returns

[11] Kurt, D. (2022, February 9). Emergency fund. Investopedia. https://www.investopedia.com/terms/e/emergency_fund.asp

[12] Team, T. I. (2025, April 4). Recession: Definition, causes, examples and faqs. Investopedia. https://www.investopedia.com/terms/r/recession.asp

[13] Segal, T. (2024, July 13). The Great Depression: Overview, causes, and effects. Investopedia. https://www.investopedia.com/terms/g/great_depression.asp

[14] Smith, K. A. (2025, March 19). How long do recessions last?. Forbes. https://www.forbes.com/advisor/investing/how-long-do-recessions-last/

[15] Petzel, T. E. (2022). Modern portfolio management: Moving beyond modern portfolio theory. John Wiley & Sons, Inc.

[16] Duré, E. (2025, January 16). Why day-of-the-week investing is a no-go strategy. Credit Card, Mortgage, Banking, Auto. https://www.chase.com/personal/investments/learning-and-insights/article/why-day-of-the-week-investing-is-a-no-go-strategy

[17] Moore, S. (2020, December 15). Busting the myth of market timing. Forbes. https://www.forbes.com/sites/simonmoore/2016/03/07/the-myth-of-market-timing/

[18] Niedens, L. (2023, August 6). New report affirms old warning: Investors shouldn’t try to “time the market.” Investopedia. https://www.investopedia.com/new-data-affirms-old-rule-do-not-try-to-time-markets-7569835

[19] Schwab Center for Financial Research. (2023, September 13). Does market timing work?. Schwab Brokerage. https://www.schwab.com/learn/story/does-market-timing-work

[20] Frazzini, A., & Lamont, O. (2008). Dumb money: Mutual fund flows and the cross-section of Stock returns. Journal of Financial Economics, 88(2), 299–322. https://doi.org/10.3386/w11526

[21] Merton, R. C. (1981). On market timing and investment performance. i. an equilibrium theory of value for market forecasts. The Journal of Business, 54(3), 363–406. https://doi.org/10.1086/296137

[22] The Investopedia Team (2025a, January 11). 6 asset allocation strategies that work. Investopedia. https://www.investopedia.com/investing/6-asset-allocation-strategies-work/

[23] Edelman, R. (2011b). The truth about money 4th edition: Everything you need to know about money (4th ed.). Harper Paperbacks.

[24] Petzel, T. E. (2022a). Modern portfolio management: Moving beyond modern portfolio theory. John Wiley & Sons, Inc.

[25] Anarkulova, A., Cederburg, S., & O’Doherty, M. S. (2023, November 1). Beyond the status quo: A critical assessment of lifecycle investment advice by Aizhan Anarkulova, Scott Cederburg, Michael S. O’Doherty :: SSRN. SSRN. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4590406

[26] Hayes, A. (2022, January 21). 100% equities strategy: What it means, how it works. Investopedia. https://www.investopedia.com/terms/1/100-equities-strategy.asp

[27] Loo, E. (2013). Stocks vs. bonds over the past 100 years. Perspectives on Politics, 11(2). https://doi.org/10.1017/S1537592713001102

[28] Damodaran, A. (2025, January). Historical returns on stocks, Bonds and bills: 1928-2024. Welcome to Pages at the Stern School of Business, New York University. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html