New Investors Try to Predict Stock Prices. The Best Investors Do This Instead.

Is chess about predicting moves?

Most people think that chess is about knowing every move in advance. It's like planning a rocket launch - you map out every object, calculate exact trajectories, and execute everything in a pre-defined sequence.

For this article, let's call this "prediction": The idea that we can calculate everything in advance in a perfect, pre-defined series of events.

In chess, these pre-planned sequences (called "tactics") are much shorter than one would expect. The average chess player can only plan tactics that are 4 moves long - nowhere near an entire game.

Contrary to popular belief, chess isn't just about predicting moves. It's also about trying to get advantageous positions.

What does this mean? Here's an example to illustrate:

The knight in the photo below can attack the red squares around it.

Because it's placed in the center, it threatens many of the squares near the enemy in rows 5 and 6.

I don't know exactly which pieces will step on those squares protected by the knight. All I know is that placing the knight in the center makes it LIKELY that I'll be able to play a good tactic later on.

This is what I mean by "positioning": Placing yourself in positions where you are more likely to get positive results - regardless of what those results will be.

Focus on positioning and the tactics will take care of themselves.

The best investors don't rely on exact predictions

You'll often see stock reports and methodologies that claim to predict price movements. They'll say, "This stock will go to 150!", implying that you should buy it at any price below 150.

Great investors like Warren Buffett don't play this game of predicting exact prices.

Investments can unfold in many ways. Life is inherently chaotic, and we must account for this chaos in our decision-making.

When someone says "This stock WILL go up to 150!" with absolute certainty, they forget the other possibilities:

- A worldwide pandemic can emerge out of nowhere.

- New laws can destroy profitability.

- Political rivals can attack - and close down - the companies you own.

- New competition can pop up.

- A scandal can scare away customers.

- A fire can destroy inventory and other assets.

The list goes on. Stocks can ALWAYS go down.

How do you win in such an unforgiving environment? Instead of predicting prices, the best investors position well, only going into investments where the odds are stacked in their favor.

The Margin of Safety

The function of the margin of safety is, in essence, that of rendering unnecessary an accurate estimate of the future.

Benjamin Graham

The three most important words in investing... Margin of Safety.

Warren Buffett

When you expect a bridge to support 1-ton trucks, you would be wise to engineer it to handle 5 tons instead. This allows the bridge to live through unpredictable outcomes, like earthquakes, unusual loads, strong winds, and so on.

We call this over-preparation the "Margin of Safety".

In investing, we build a margin of safety by buying at low prices compared to the possible scenarios we can see for the company.

Here's an example.

Let's say Company X is planning to build a factory for a new product.

An analyst might say, "Wow, they're building a new factory! People WILL love this stuff. They're going to go to 100 FOR SURE!"

Sure, that's possible. However, that's just one possible scenario.

There are many scenarios we can think of for this situation. To simplify things, let's only cover the best and worst cases:

- If customers buy all the factory's output, the company will be worth 100 per share.

- If customers hate the new product, the company will be worth 40 per share.

Want to learn how to calculate the per-share worth of stocks? Click here to get started.

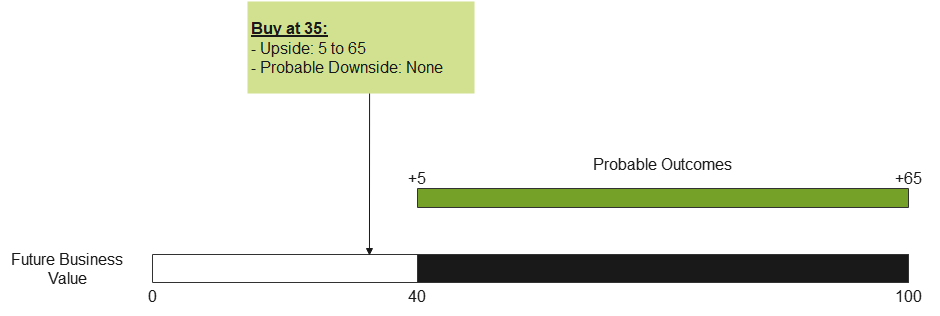

Here's a diagram of our probable scenarios:

Note that I didn't include incredibly unexpected events, like a meteor hitting Company X's HQ. Let's call these events "Improbable Downsides" - things like nuclear war, an earthquake wiping out all a company's assets, and the heat death of the universe.

Now that we have a range of possible events, we can think about positioning ourselves along this gradient, instead of just predicting what the "one and only price" will be in the future.

For this example:

- Upside = Possible future gain in business value based on buy price

- Downside = Possible future loss in business value based on buy price

Here's what could happen if you buy Company X at 35 per share:

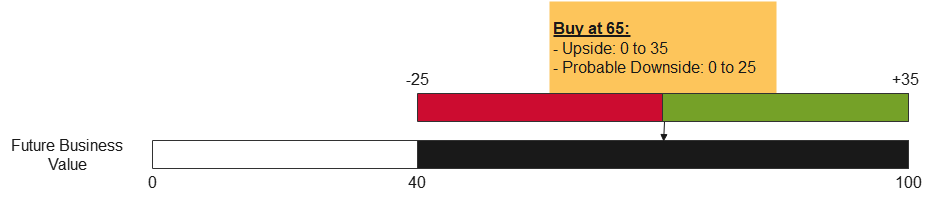

And here's what could happen if you buy at 65 per share:

Observe: The lower your purchase price, the more likely you are to get a good return.

As you can see, positioning yourself at the lower end of the spectrum increases the likelihood of a good result.

The best part about buying at low prices? It doesn't just protect you against probable downsides - it protects you against improbable downsides as well!

To illustrate:

- If you purchased a 1 million peso restaurant and had to close it because of COVID, then you lost 1 million pesos.

- If you purchased the same restaurant for 40 million pesos and had to close it, then you lost 40 million pesos.

Buying at a discount - with a margin of safety - positions you to maximize your possible gains and minimize your possible losses. The bigger the discount, the greater the benefit.

New investors try to predict stock prices. The best investors position instead.

Investments can unfold in an infinite number of ways, both good and bad.

The common way to react to this chaos is to try to control and calculate our way through the uncertainty.

We look for precise values in an inherently imprecise world. When we fail in our predictions, we blame it on our inadequate foresight and try to brute force our way through even more calculations.

While research and calculation are essential to any investment plan, after a certain point, you have to accept that you can always be wrong. Life is too chaotic to be precisely calculated.

If we can't even have 100% certainty predicting a physical phenomenon like the weather, what makes you think we'll have any luck predicting the stock market, which is affected by physical, political, and psychological factors (among others)?

The best any of us can hope for is to open ourselves to serendipity: to position ourselves in ways that stack the odds in our favor.

We place our bets when we have good odds. Then we wait, knowing it'll probably average out alright in the end.