Making Sense of Bear Markets

I’m writing this in 2023. For most readers (millennials and younger), the ongoing economic downtrend is probably your first time managing your finances during a bear market.

Bitcoin lost half its market price from its peak. Axie, once a national sensation, is now irrelevant. The Philippine Stock Exchange Index is back at its 2013 price. Real estate occupancy continues to decline. Bonds and debt also suffered with the rise in interest rates.

This has been a period of great surprise. For the past decade, it seemed like investments could only go up.

The Hubris of Bulls

This mindset - that things only go up - was so widespread that during the peak of the recent bull market, that I regularly saw comments online claiming that portfolio gains of 20% per annum were low.

To get a feel of how much hubris is in that statement, consider that Warren Buffett’s lifetime track record hovers at around 20% per annum.

Investing is one of the only fields where you can find such misplaced self-confidence. I’ve yet to find a basketball enthusiast say that they could easily beat Michael Jordan, or a non-professional chess player say that they would surely beat Magnus Carlsen.

Yet these kinds of comments are common during bull markets: They were common during the 1990s Dot-com Bubble, during the 2000s Housing Bubble, and during the recent Everything Bubble in the 2020s.

Sadly, during these periods of misplaced euphoria, many retail investors took on heavy leverage and concentrated bets, wiping out many fortunes and retirement accounts when the inevitable downturns presented themselves.

A Sense of History

“Past performance is no guarantee of future results.”

Various Investment Fact Sheets

Over a decade or so, markets can seem predictable and linear. This can give newcomers the impression that things only go in one direction.

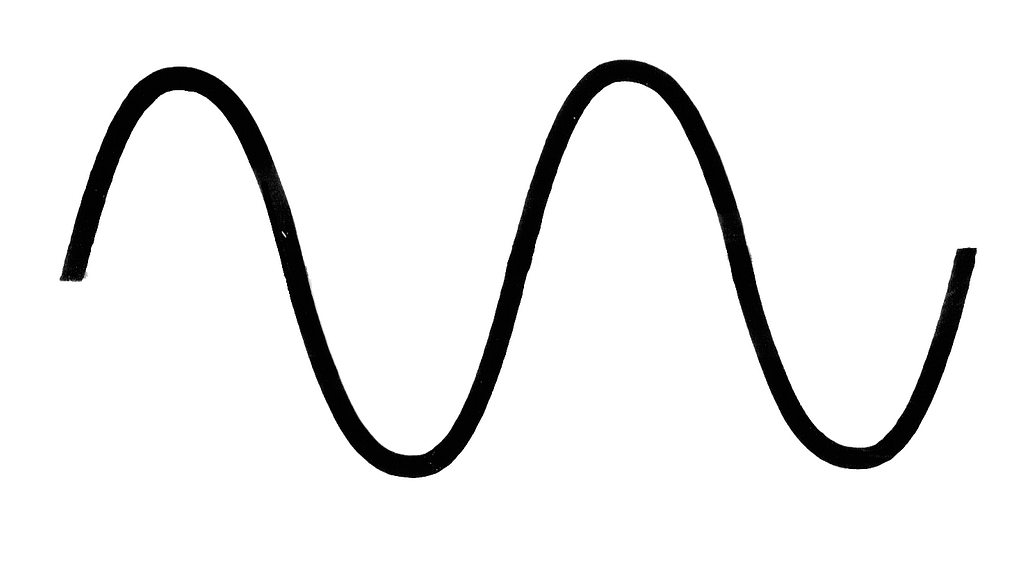

However, if you zoom out and take on a multi-decade time horizon, you’ll find that most aspects of the economy are cyclical over the long run.

The long-term oscillations of markets are normal. It just doesn’t feel that way because our minds are not wired to observe multi-decade patterns.

Knowing history is important. Reading at least one book about this topic (like “Boom and Bust” by John Turner) is, in my opinion, essential for anyone who dares to make active investment decisions.

People who lose their life savings in markets tend to lack fear. They see things go up all their lives, so they assume the trend will continue and bet everything they have. Then the bubble pops (as it always has over the past centuries) and they lose everything.

Knowing history protects you from this tendency. If you know how things have gone wrong in the past, you’re more likely to avoid them in the future.

Bubbles and busts aren't new. They’re unavoidable: humans are wired to gamble on lottery tickets and price uptrends. And even if our current generation of investors learn from their mistakes, we'll always have the next generation of young, inexperienced investors to fuel whatever the next bubble will be. It pays to learn about them because we have many more ahead of us.

The Life Cycle of a Bubble

- A great idea emerges: “Have you heard of this thing called the internet?”

- People buy for good reasons: “Internet adoption is increasing. Yahoo will make lots of money. Buy Yahoo stock!”

- Mere price increases entice the less knowledgeable to buy: “I might not know what this Internet thing is, but everyone’s making money off Yahoo stock. Let’s buy!”

- People start believing in infinite money generators: “Internet companies don’t need profits! This is the new economy!”

- A negative catalyst cuts the uptrend. Unprofitable internet companies started to go bankrupt, challenging the belief that anything on the internet is invincible.

- Widespread Panic.

Investing With Cyclicality

“Bull markets go to people’s heads. If you’re a duck on a pond, and it’s rising due to a downpour, you start going up in the world. But you think it’s you; not the pond.”

Charlie Munger

Because of the cyclical nature of the economy, the real test of an investing strategy is not its ability to make returns. Anyone can make money in a bull market. The mark of a good investing strategy is the ability to survive a downturn.

If your strategy assumes a constant uptrending environment, then it’s a bad strategy. Downtrends are inevitable. There’s no point multiplying your money during an uptrend only to lose it all when things turn south.

This is why I stick with the value investing philosophy. The principle of purchasing with cash flows in mind - as opposed to capital gains - applies to both uptrends and downtrends in markets.

Cycles are Good News Too

While this article has taken on a negative tone, cyclicality does have a good side: Things enter downcycles, but they inevitably enter upcycles as well.

For many, the current doom and gloom appear permanent. Things seem like they will never get better. However, just as the recent bear market caught many by surprise, we’ll also never quite know when the next upswing will emerge.

In a cyclical environment, the key is to think long-term, through multiple cycles. While it’s dangerous to assume permanent uptrends, it’s also equally dangerous to assume permanent downtrends, which leads to the unspeakable opportunity costs of parking your wealth in low-yielding instruments.

The correct way to act is to take reasonable risks for acceptable returns, while always keeping in mind that markets can, have, and will go south. Never invest with unchecked bravado, and always have a trace of fear and risk-awareness at the back of your mind.

Do comprehensive due diligence. Then when a good, safe opportunity presents itself, invest.