How A 1% Fee Can Destroy 32% Of Your Retirement

Many are unaware of how much fees from financial products cost over the long run. Just a 1% fee per annum can reduce your retirement net worth by 32%.

Many people want to get into investing these days. That's great - it's a much more reliable way to grow your wealth over the long run compared to stashing your paychecks in a bank account.

Most people, however, are too busy to manage their own money. So instead, they go to mutual funds so that they can set it and forget it.

Having experts manage your investments for you is a great idea. However, I've found that many are unaware of how much the fees from these financial products cost over the long run.

As the title of this post says, just a 1% fee per annum can reduce your retirement cash by 32%.

How does that make any sense? How can such a small number (1%) have such a big impact (32%)?

Let's start with a common misconception about investment returns.

The "Rent Model" of Investing Is False

We intuitively think about investment returns as if they're rent from properties: We invest in an asset, then we collect cash as time passes.

Let's say you buy a 100 million peso property and rent it out at 3% per year. That's 3 million pesos per year of income.

How much richer would you be if the rent went up to 4%?

It's natural to think: "I would be 1 million pesos per year richer".

This, however, is the wrong answer.

Why? Because we're assuming that we can't reinvest the income.

The "Viral Model" of Investing (AKA: Compounding)

Instead of thinking of capital as rental properties, it makes more sense to think of capital as a virus.

Money begets money, which begets more money, which begets more money... and so on.

Think about it this way. Let's say, hypothetically, that each COVID patient spreads the virus to 1 other person each day:

- COVID started with just one person who got infected. (0 infected -> 1 infected)

- Then that one person infected another person. (1 infected -> 2 infected)

- Then those 2 people infected another person each (2 infected -> 4 infected)

- In just 8 days, 128 people are already infected! (4 -> 8 -> 16 -> 32 -> 64 -> 128)

If we were following the "Rent Model" with COVID, we would only have 8 people infected by day 8 (i.e. 1 infection per day) – a gross miscalculation, to say the least.

This viral, compounding property of COVID allowed it to engulf the globe within a year. It was able to do this because its growth accelerated over time: The more people were infected, the more the virus could spread.

While capital does not grow at the speed of COVID, it still follows the same principle of compounding growth. When earnings are reinvested, your money's growth accelerates over time.

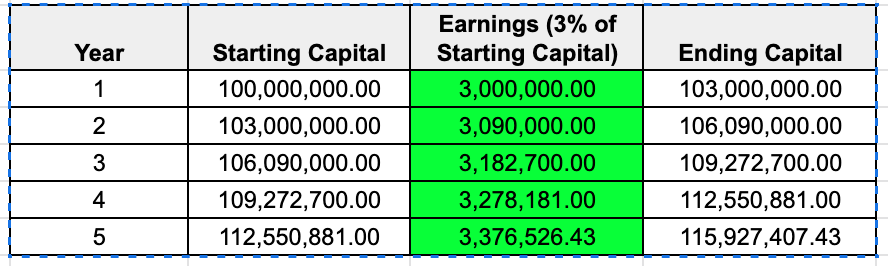

As an example, here's the 100 million capital from earlier earning 3% per year under this "Viral Model" of investing:

Notice that the earnings increase every year. By year 5, we're already earning over 10% more per annum than when we started.

Compounding Amplifies Long-Term Earnings

The impact of compounding gets heavier as time passes.

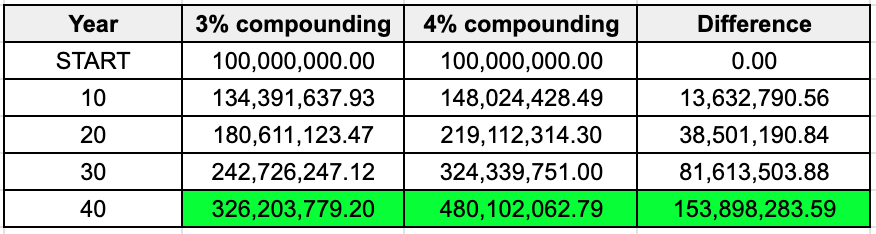

Consider two investments that start at 100 million. One investment compounds at 3%, while the other compounds at 4%.

An average career lasts around 40 years. How big of a difference will we see between these two strategies over that time horizon?

Notice: As time passes, the difference between the 3% and the 4% strategy widens. By the end of these investors' 40 year careers, the 3% compounder is already behind by over 153 million -- a 32% difference.

All that from just a 1% difference in annual returns!

Actionable Steps

Now you know how small changes can have a massive impact on your investments. How can you act on this?

1. Know Your Fees

Financial companies don't work for free.

Financial products like funds and insurance have fees. Many hover around 1-2% of your capital annually - a massive slice of your retirement.

Know the fee structure of every financial product you purchase, and weigh if the benefits of that product outweigh its costs.

2. When In Doubt, Use Low-Cost Index Funds

The vast majority of professionally managed funds do not beat the index. [1]

There's a common misconception that portfolios managed by MBA's will do better than a no-brainer index fund. Statistically, this is false.

When in doubt, just buy the index using the lowest-cost index fund you can find, like FMETF in the Philippines or SPY in the USA.

There are very few things in life that both:

- Takes less than a day to study

- Can save you up to 32% of your retirement net worth

Low-cost index investing is one of them.

References

[1] https://www.cnbc.com/2022/03/27/new-report-finds-almost-80percent-of-active-fund-managers-are-falling-behind.html