Business and the Myth of Easy Money (Part 2: Misconceptions About Business)

Quick Recap

This series aims to break the "Myth of Easy Money", which is the idea that starting a business is a guaranteed way to make more money for less time and effort compared to working a job.

In part 1 of this series, I described how Work and Investment are the only two ways to make money.

For this series, "Work" is any income-generating activity that requires your time, while "Investment" is any income-generating activity that requires your assets.

Work and Investment are the only two ways to make money. Business does not exist independently as a third way of making money - it is nothing more than a combination of Work and Investment.

If you haven't read part 1 of this series, I highly recommend doing so here: Business and the Myth of Easy Money (Part 1: Defining Business)

Two Big Misconceptions About Business

This article will cover two big misconceptions I frequently hear when it comes to starting your own business.

First: Business owners ALWAYS make more money for less effort compared to employees.

Second: Employees have an earnings ceiling, while entrepreneurs can scale their earnings infinitely.

But before getting into these, let's examine why these misconceptions exist.

Bad Accounting Causes Misconceptions

People think these misconceptions are true because they don't do their mental accounting properly.

The main accounting error I see is people thinking about income in isolation - "I am making 100 million pesos per year in this business. Therefore, this business is good."

Income does not exist in a vacuum. We must account for the Investment and Work we allocated to find our true profitability because these resources can always be placed somewhere else.

For example: Let's pretend our businessman had to purchase 100 billion pesos worth of assets to get this 100 million peso annual income. Is it still a good business?

The answer is a resounding NO!

To make 100 million pesos of annual income using 100 billion pesos of capital means that our businessman is only making 0.1% per annum off his capital - a pathetic rate of return

Had he just bought 4% government bonds instead, he would be making 4 billion pesos a year instead of 100 million pesos. On top of that, he wouldn't have had to do any Work to get this income.

| Inferior Businessman | Superior Bond Investor | |

| Income from 100 billion pesos of capital | 100m | 4b |

"But I'm making money either way. So what?"

Proper accounting matters because it reveals our opportunity costs.

If, through proper accounting, you realize that the business you've been pouring so much time, effort, and money into isn't even beating the historical 8% of the stock market index, then you have an opportunity to increase your lifetime returns by shifting your Investment to a different asset (e.g. from low-returning business assets to an index fund).

I'm not saying businesses are inferior to jobs.

I'm also not saying that jobs are inferior to businesses.

I'm just saying this: run the numbers properly for each unique situation. There are times when you're faced with amazingly profitable business opportunities, and there are times when you're better off working a job and just investing the money in passive securities.

These are big decisions, so don't wave them away with baseless rules of thumb like "Business is always better! There is no such thing as a job that beats a business!"

Run the numbers, and do it with no distortions. The Myth of Easy Money was born out of bad accounting, and the purpose of this article is to break this myth by showing you what the correct accounting looks like so you can see the gap between staying in a job and starting your average business isn't nearly as big and certain as most people think.

Keeping all this in mind, let’s go through each misconception and see how accurate accounting destroys the Myth of Easy Money.

Misconception 1: Business owners always make more money for less effort

Business owners seem to always be hanging out at golf courses and traveling. They make tons of cash without working much.

That must mean business is easy, right? Everyone should quit their jobs and start a business - it's free money!

According to the Small Business Administration of the USA, 50% of small businesses fail within the first 5 years. The Washington Times published that only 1/3 of businesses last long enough to be passed on to a second generation, while only 12% get passed on to a third. And a study conducted by Dr. Michael Freeman found that 72% of entrepreneurs report mental health concerns.

Money is not free. Everything costs something - whether it be resources, efforts, skills, unique information, uncertainty, risk, your mental well-being, etc. there is ALWAYS a cost associated with making money.

Why do people think money is free when it comes to business?

It’s because they don’t account for the Investment of the business owners.

A disgruntled long-time lawyer who buys into this misconception might say this:

“Why should I, a lawyer, continue working for 200k a month, when you can start a business that pays you a million a month on a 4-hour workweek?"

In bad accounting, their annual incomes might look like this:

| Business Owner | Lawyer Employee | |

| Income | 12m (1m per month) | 2.4m (200k per month) |

What's wrong with this table?

This is bad accounting because it's not an apples-to-apples comparison. The business owner's income is composed of both Work (CEO of the company) and Investment (the capital tied up with the business), while the lawyer is only measured through their Work component.

It's like comparing a bare-fisted martial arts fighter to someone with a gun. The armed person will always win because the fight isn't set up correctly.

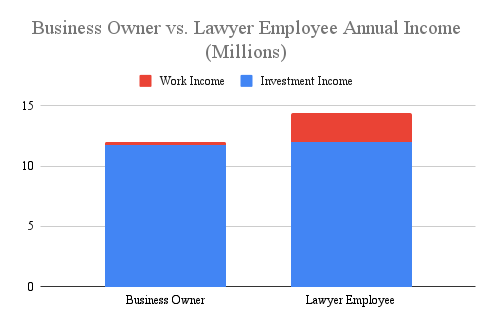

How do we correct this bad accounting?

To correct the error, we need to split the business owner's income into the Work and Investment components, and then we need to give the employee a comparable amount of assets Invested at market rates of return.

Here are the steps:

- Split the business owner's income into Work and Investment. Their Work is equal to the market rate for their job, while the rest of the income will be assigned to Investment returns.

- Identify the business owner's Investment capital. Assume the employee can Invest the same capital at market rates of return.

Why do these modifications make sense?

When deciding to start a business, you have a certain amount of capital ready to deploy.

If you choose to start a business, you Invest the capital in hard assets like land, trucks, inventory, and computers.

If you choose to stay an employee, then you'll Invest the capital in more passive assets like stocks, bonds, and real estate.

Either way, the capital has to go to some form of Investment. Therefore, the Investment capital for both cases is the same.

The Work component of the business owner is assumed to be at the market rate because this is how much the business owner would pay if he wasn't doing the job himself. Therefore, the portion of the business's income due to the owner's Work is equal to the market rate of the job that he is doing.

These accounting modifications would make the Work and Investment income components visible for both the employee and the business owner, making it an apples-to-apples comparison. This is in contrast to the bad accounting earlier, where the employee is assumed to have zero Investment.

To call on the earlier analogy, correcting the bad accounting would be like giving our martial arts fighter a gun, so we can see who would win in a fair fight.

Example: Applying correct accounting

Let's say we have the following inputs:

- Business owner has 150 million pesos of tied-up capital in the business in land, machines, and so on.

- Business owner mainly audits his company, not doing much else.

- The average salary on job sites for an auditor is approximately 20k pesos per month [1].

- Business owner's total annual income is 12 million pesos per year, or an 8% return on 150m of equity. We assume the business owner draws their salary from this income.

- According to data collected by Professor Aswath Damoradan of NYU, 8% is the average return on equity of retail distributorship firms in emerging markets as of January 2024 [2].

- Lawyer employee makes 200k per month.

- The stock market index is assumed to return 8% per annum over the long run, as it has for the past century. Stocks are a logical vehicle to pit against the business owner because stocks are businesses, making our comparison apples to apples.

Is the business owner in this case superior to the employee? Here's what the accounting says when we do it properly:

| Business Owner | Lawyer Employee | |

| Investment Income (150m pesos capital) | 11.76m (Total annual income minus Work salary) | 12m (Assumed 8% stock market return off invested capital) |

| Work Income | 240k (20k per month auditor salary) | 2.4m (200k per month salary) |

| Total Annual Income | 12m | 14.4m |

For this example, the lawyer comes out on top.

By giving the employee a comparable amount of capital in our mental accounting, we're able to have an apples-to-apples comparison.

Insights from Correct Accounting

The misconception we're attacking is the idea that businesses inherently have better returns compared to jobs.

The main error is to assume that these higher returns are free. In reality, these profits came at a cost: the business owner had to Invest in the business's assets.

How can employees keep up? Employees can invest too. Stocks, bonds, real estate, additional education for career advancement, and other investments are completely within reach of any employee.

So if you're a highly paid employee like a doctor, lawyer, or data scientist, maybe think twice before quitting your career to become an Instagram baker just because "it's a business and businesses always make more money than jobs". You'll have to run your numbers before making that decision. There is, in fact, a chance that placing your money in passive assets while keeping your day job will yield better returns than placing your money in ovens and bread flour.

Misconception 2: Employees have an earnings ceiling, while entrepreneurs can scale their earnings infinitely

Many people have the impression that business owners are the only ones who can scale their earnings infinitely. This is wrong because the main scaling factor of one's total income is Investment, and employees also have access to Investment.

All Investment activities are effectively infinitely scalable

You only have 24 hours in a day, so your Work will generally hit a ceiling at some point. But whether you have 1000 pesos or 100 million, you can always find an Investment to deploy all of your capital, which makes Investment an infinitely scalable vehicle for wealth generation.

There are, of course, exceptions once you start handling billions of dollars of capital, but for most readers and myself, I think this isn't going to be a problem (sadly). So we can effectively treat Investment activity as infinitely scalable.

Why do people think that employees can't scale earnings?

For the same reason as the first misconception: people don't account for employees' investments.

Here's what our imaginary disgruntled lawyer might say about this:

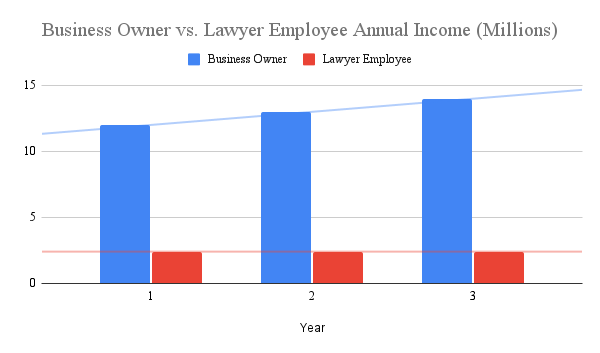

“My lawyer salary has been stuck at 200k per month, while this business owner I know seems to keep making more money each year! I should just start a business!"

Expressed in bad accounting, here's what this might look like:

| Year | 1 | 2 | 3 |

| Business Owner | 12m | 12.96m | 13.99m |

| Lawyer Employee | 2.4m | 2.4m | 2.4m |

What's wrong with this table?

This is bad accounting for the same reason as the first misconception: The business owner's income is composed of both Work (CEO of the company) and Investment (the capital tied up with the business), while the lawyer is only measured through their Work component.

How do we correct this bad accounting?

We follow the same process as the first misconception: We account for the lawyer's Investment, and then we split their incomes into a Work and Investment component, so we can see where the growth is coming from.

If you'll recall, here are the steps to do this:

- Split the business owner's income into Work and Investment. Their Work is equal to the market rate for their job, while the rest of the income will be assigned to Investment returns.

- Identify the business owner's investment capital. Assume the employee can invest the same capital at market rates of return.

In the first misconception we already covered why these modifications make sense, so let's move on to an example.

Example: Applying correct accounting

Let's say we have the following inputs:

- Business owner has 150 million pesos of tied-up capital in the business in land, machines, and so on.

- Business owner can reinvest his income in assets that generate an 8% rate of return

- Business owner mainly audits his company, not doing much else.

- The average salary on job sites for an auditor is approximately 20k pesos per month [1].

- Business owner's total business income is at 8% return on equity. This means he gets 12 million pesos in the first year, which is 8% of 150m. We assume the business owner draws their salary from this income.

- According to data collected by Professor Aswath Damoradan of NYU, 8% is the average return on equity of retail distributorship firms in emerging markets as of January 2024 [2].

- Lawyer employee makes 200k per month.

- Both Invest all their income from Work and Investment.

- The stock market index is assumed to return 8% per annum over the long run, as it has for the past century. Stocks are a logical vehicle to pit against the business owner because stocks are businesses, making our comparison apples to apples.

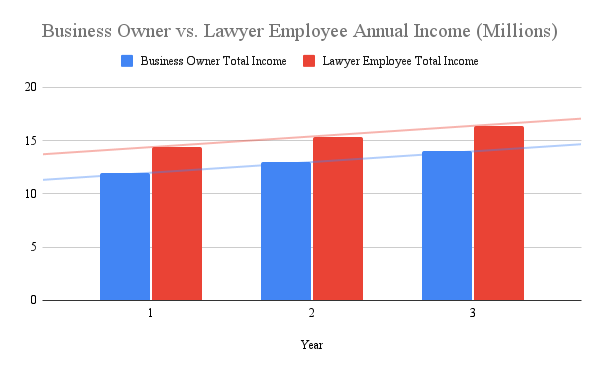

Is the business owner the only one who can scale his income? Let's see what the accounting says when it's done right:

| Year | 1 | 2 | 3 | |

| Business Owner | Capital | 150m | 162m | 174.96m |

| Investment Income | 11.76m | 12.72m | 13.76m | |

| Work Income (20k per month) | 240k | 240k | 240k | |

| Total Income | 12m | 12.96m | 13.997m | |

| Lawyer Employee | Capital | 150m | 164.4m | 179.76m |

| Investment Income | 12m | 12.96m | 13.997m | |

| Work Income (200k per month) | 2.4m | 2.4m | 2.4m | |

| Total Income | 14.4m | 15.36m | 16.397m |

Insights from Correct Accounting

The original bad accounting was making an unfair comparison because it included the Investment income of the business owner, while only isolating the Work income of the lawyer.

Looking at the correct accounting, we see two things.

First: The lawyer can also scale his income through investment. The only reason we thought the lawyer was stuck at his income level was because we were just looking at his Work.

Second: The business owner's Work component is also stuck at a certain level.

From the business owner's point of view, this isn't obvious because he only sees the growth of his total bank account. However, we know that the business owner works as an auditor in the business, and thus, some part of the total business income is due to the savings of not having to hire another auditor to do the job - i.e., the owner's salary for doing auditor work. It makes sense, therefore, to break down the business owner's income into the Investment and Work components.

The key lesson here is that you don't need to quit your job just to experience an infinitely scaling income. Just add Investments to your income sources. That is, after all, how business owners got their scaling incomes in the first place.

Conclusion: Everything Costs Something

The Myth of Easy Money claims that when it comes to business, money costs nothing. Believers claim that you can put the same resources in a business as you would in a job and you will always come out with a higher income relative to how much resources you put in.

Believers of the Myth have 2 big misconceptions. First, they think you can always get more for less through business. Second, they think that business is the only way to scale earnings over time.

These misconceptions and the Myth of Easy Money are borne out of bad accounting. What causes this bad accounting? The visibility of peoples' income sources. Business inherently contains Work and Investment income components, while for jobs, only the Work component is easily visible.

This creates a lopsided comparison where business appears superior every time because we're not accounting for the Investment of the employee. The bad accounting is as nonsense as making a bare-handed martial artist fight a person with a gun - you're setting up an unfair competition so that the armed person always wins.

By bringing in the Investment income component of employees, we're able to make more level-headed, apples-to-apples comparisons between running a business versus being an employee. This correct accounting reveals that there are times when being an employee can win out versus starting a business.

In the next article

Now that we've covered misconceptions about business and ruined the Myth of Easy Money, business might look unattractive. Still, there are some cases where starting a business is financially superior to working as an employee.

Now that we've crushed the false advantages of starting a business (i.e., "Easy, guaranteed money"), in the next article, we're going to take a more positive tone and talk about what the real benefits of business are, and in what cases it might make sense to quit your day job to become an entrepreneur.

You can read the next article here: Business and the Myth of Easy Money (Part 3: The True Benefits of Business)

References

[1] https://ph.indeed.com/career/auditor/salaries

[2] https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datacurrent.html